EM currencies and Covid crisis: the case of South Africa

South Africa's fragile fiscal position worsens the outlook of its currency.

Published by Alba Di Rosa. .

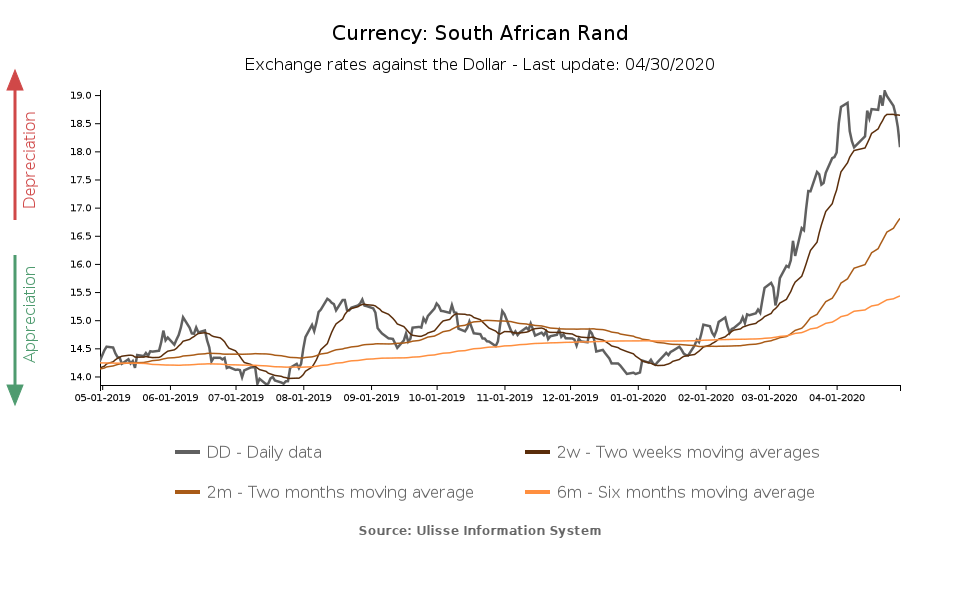

Exchange rate Uncertainty Africa Exchange rate risk Emerging markets Exchange ratesAfter the cases of Mexican peso and Brazilian real, discussed last week, let us now analyze the dynamics of South African rand, another of the floating EM currencies that has depreciated the most against the dollar since early 2020, particularly following the outbreak of the Covid crisis. Since the beginning of the year, the rand has lost about 30% of its value against the greenback, hitting highs of almost 19 rand per dollar last week, to then show some signs of recovery in the last few days.

Taking a closer look at the reasons of the weakening, as emerged for Latam currencies we can confirm that structural weaknesses of the national economy have added up to phenomena specifically triggered by the pandemic, such as risk aversion and the drop in commodity prices; this combined action has therefore worsened the effect of the Covid shock on the currency.

Starting from the economic growth factor, data show that the situation was quite precarious even before the start of the epidemic. In 2019, South Africa's GDP growth was in fact weak, and Q4 ended with a contraction (-0.6% YoY). Before the pandemic, the IMF forecast a 1.1% GDP growth for 2020, which is quite low for an emerging country; in the last World Economic Outlook, this value was revised to -5.8%. Therefore, as in many countries of the world, a deep recession is expected, which could keep on weighing on the fragile South African fiscal system in the years to come.

In addition to low economic growth, other elements of weakness that weigh on South African economy can be listed as follows:

- Fragile fiscal position

Between 2015 and 2019, public debt as a share of GDP increased by more than 10 percentage points, and is expected to keep on rising in the coming years. Fiscal deficit as a share of GDP is high, as well, amounting to 6% in 2019; given the current emergency situation, the IMF expects the ratio to rise to 13% in 2020 and to slightly decline the following year. - Very high unemployment

According to IMF data, in 2019 unemployment in South Africa reached the historic high of 29%, a figure that is expected to increase to 35% in 2020.

This situation of pre-existing difficulties, to which is added the Covid-19 factor, has led several rating agencies to downgrade South Africa in recent months. The biggest blow came from Moody's, the last rating agency to consider the country's debt as investment grade, that on March 27 rated the South African debt as "junk", as well.

Light at the end of the tunnel?

In spite of the critical scenario just described, the currency has shown a slight recovery in recent days, which can be attributed to several factors:

- Improved risk sentiment, given the line of gradual reopenings that is prevailing globally

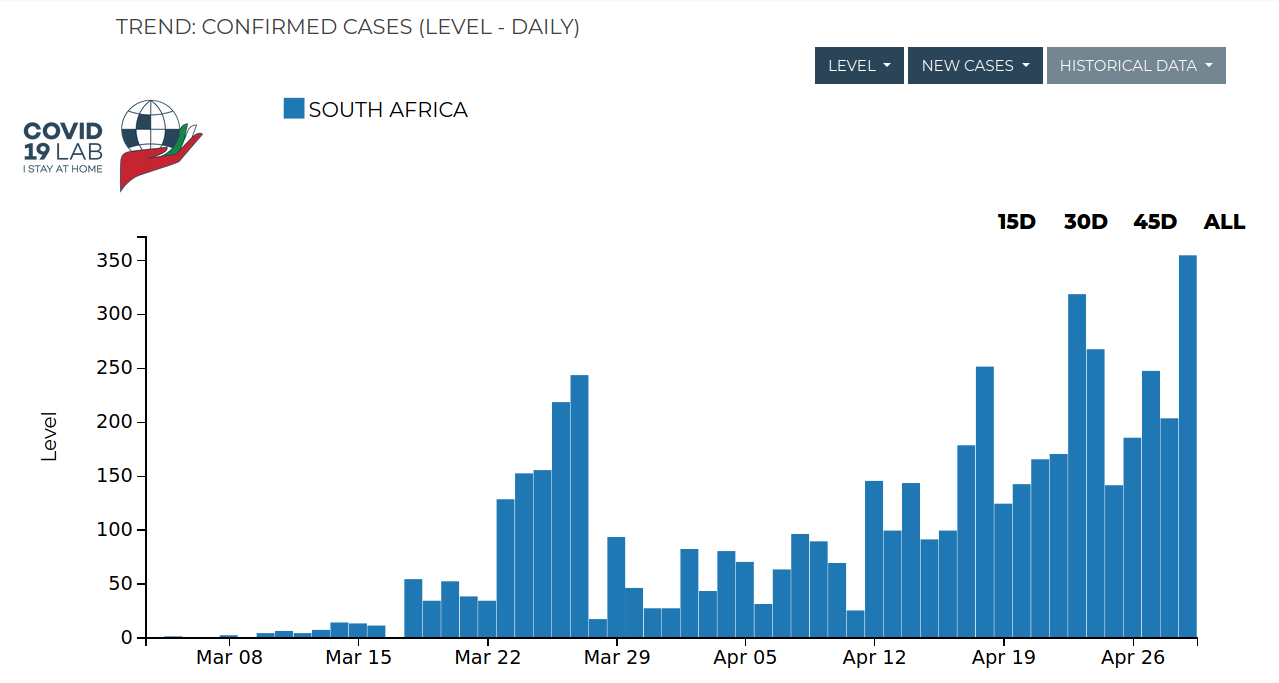

- A loosening of the lockdown in South Africa, starting from May 1st, announced at the end of last week. While this news sounded good for investors, hinting at a restart of the economy, there are still concerns about the effects of this decision on public health: although Covid-19 confirmed cases are relatively low in South Africa, data show that the peak has not yet been reached, as can be seen from the number of new confirmed cases, still on the rise.

- President Ramaphosa’s announcement, dating back to the beginning of last week, of a 500 billion rand ($26.9 billion) economic stimulus plan. For 95 out of the 500 billion rand needed, South Africa resorted to international institutions such as the International Monetary Fund and the World Bank; the problem with this choice is that reaching an agreement with the lenders might take some time.

All in all, the rand emerges as a very fragile currency, on the watchlist of the global emergency.